In a move that’s set to revolutionize the way financial data is accessed and utilized, Instachronicles has learned that Nasdaq and Nuam are taking their technology partnership to the next level. This strategic collaboration has already been making waves in the finance sector, but the recent announcement signals an exciting new chapter in their alliance. By combining their expertise in data analytics and cutting-edge technology, Nasdaq and Nuam are poised to provide investors and market participants with a faster, more efficient, and more insightful way to analyze and act on market trends. As the financial landscape continues to evolve at a breakneck pace, this partnership is poised to give market players a significant edge in an increasingly competitive environment. In this article, we’ll take a closer look at the details behind this partnership and what it means for the future of financial data analysis.

Nasdaq, nuam Extend Technology Partnership: Revolutionizing Latin American Capital Markets

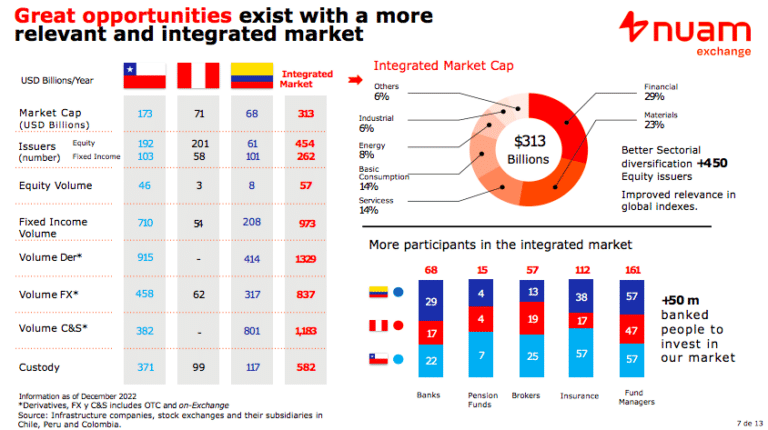

The nuam exchange, a consolidation of markets in Colombia, Peru, and Chile, has extended its technology partnership with Nasdaq to provide a single market across asset classes. This strategic move aims to improve access to the region for international investors and streamline market participation for local and foreign investors alike. Instachronicles delves into the nuances of this partnership, examining its implications for market infrastructure, regulatory frameworks, and operational enhancements.

Market Consolidation: A New Era for Latin America

Background and Rationale

The formation of a technology partnership between nuam and Nasdaq marks a significant milestone in Latin American capital markets. This consolidation aims to provide a single market across asset classes, streamlining operations and improving efficiency. Juan Pablo Córdoba, chief executive at nuam exchange, emphasized the vision for creating a more efficient capital market in the region. Córdoba, with extensive experience in financial institutions such as the International Monetary Fund and the Colombian Ministry of Finance and Public Credit, brings a wealth of knowledge to the initiative. The historical context includes decades of free trade agreements and cross-investment between Chile, Colombia, and Peru, laying the groundwork for a cohesive, unified market presence.

Benefits of Consolidation

The consolidation of these three markets into a single, unified entity under nuam presents several compelling benefits. Firstly, it significantly improves access to the region for international investors by providing a unified platform. This enhanced access not only facilitates scalability and ease of access for local and international investors but also promotes standardization. Standardized access, through the use of standard industry APIs, enables streamlined entry and operation within the market, reducing barriers to investment.

Regulatory Aspects

From a regulatory perspective, it is crucial to note that each country will retain its individual exchange and central securities depository (CSD). Despite these distinctions, nuam will function as a single, unified market operationally. This approach ensures compliance with local regulations while providing a streamlined, cohesive experience for users. The regulatory framework is meticulously designed to maintain the integrity of each individual market while fostering collaboration and efficiency.

Technology Partnership: Enhancing Market Infrastructure

Nasdaq’s Role in the Partnership

Central to this partnership is the integration of Nasdaq’s technological expertise. Tal Cohen, co-president of Nasdaq, highlighted the necessity of resilient and robust technology in global capital markets. This partnership extends beyond the consolidation of markets; it also encompasses the development of a new clearing platform and the modernization of the post-trade technology platform. Nasdaq’s existing relationships with Chile’s CSD, B3 in Brazil, and BMV in Mexico further bolster this collaborative effort, setting a precedent for technological advancement in the region.

Standardization and Risk Controls

Standardization and risk controls are pivotal to the success of this partnership. The platform will operate with the FIX 5.0 SP2 protocol, ensuring a universally recognized standard for financial messaging. Risk controls are implemented to maintain the quality and trustworthiness of the market, attracting larger, global participants and strengthening liquidity. These measures ensure the platform not only functions seamlessly but also upholds the highest standards of security and reliability.

Platform Operations

Operational efficiency is a cornerstone of the platform’s design. The platform will function as a single market for the user, integrating diverse asset classes and market participants. This approach simplifies the trading experience, making it more accessible and intuitive. The integration of these elements into a unified platform signals a new era of market consolidation, promoting a cohesive and robust trading environment.

Expected Use of the Platform and Users’ Access

Nasdaq and nuam exchange have extended their technology partnership to facilitate seamless trading across multiple asset classes in the Latin American region. The platform will enable users to access a unified market, reducing the complexities associated with trading across individual markets in Chile, Colombia, and Peru. This consolidation will streamline the trading process, allowing for more efficient execution and better market liquidity. Traders and investors will benefit from a consistent user experience, regardless of the specific market they are engaging with, enhancing overall market accessibility and transparency.

Mult-Asset Class Growth: Nuam’s Strategy

Launch of Combined Equity Market

Juan Pablo Córdoba, the CEO of nuam exchange, has expressed optimism about the combined equity market’s potential to increase efficiency and attract international investors. The launch, scheduled for the second quarter of 2025, is contingent upon the readiness of market participants and the implementation of a single rulebook. This rulebook will harmonize regulations across the three countries, ensuring a unified approach to market oversight and operation.

Single Rulebook and Necessary Regulatory Changes

The single rulebook is a critical component of nuam’s strategy, aiming to standardize regulatory requirements and operational procedures. This standardization will reduce the compliance burden for market participants and will streamline the trading process. Regulatory changes are expected to be finalized in the coming months, aligning the market’s infrastructure with international best practices.

Connectivity Testing and Full Market Testing

Connectivity testing is scheduled for the third or fourth quarter of 2023, followed by full market testing at the start of 2024. These tests are crucial for ensuring the platform’s robustness and reliability. By conducting thorough testing, nuam and Nasdaq hope to identify and address any potential issues before the official launch, ensuring a smooth transition for users.

Settlement Period and Issuer Participation

The new market will operate on a T+1 settlement period, enabling trades to settle one day after the transaction occurs. This shortened settlement period will enhance the liquidity and efficiency of the market, aligning with global standards. With over 400 issuers and a combined market capitalization of approximately $350 billion, the launch of the combined equity market will create a substantial market presence, attracting both domestic and international investors.

Implications and Analysis

Nasdaq’s Expanded Presence in Latin America

Through this strategic technology partnership, Nasdaq is expanding its reach in Latin America, solidifying its position as a leading provider of market infrastructure. This partnership allows Nasdaq to extend its global footprint, offering advanced technology solutions to the combined market. The partnership is expected to bolster Nasdaq’s global market infrastructure business, presenting opportunities for growth and expansion in the region.

Impact on the Region’s Capital Markets

Nuam’s vision is to foster an efficient capital market that enhances the region’s attractiveness to both local and international investors. By integrating the markets of Chile, Colombia, and Peru, nuam aims to create a unified trading environment that simplifies access for a global audience. This consolidation is anticipated to increase liquidity, reduce transaction costs, and enhance market transparency, ultimately benefiting all stakeholders. However, challenges such as regulatory harmonization and market integration must be carefully managed to ensure the success of the initiative.

Regional Cooperation and Investment

The strategic alliance between the three countries is also expected to foster greater regional cooperation and investment. With ongoing free trade agreements and cross-investment between Chile, Colombia, and Peru, the consolidation of their exchanges into one platform could further enhance economic integration and investment flows. This unified approach not only benefits regional companies but also opens up the market to a broader international investor base, potentially spurring economic growth and investment opportunities.

Conclusion

As Instachronicles reported on the Nasdaq and Nuam extending their technology partnership, the implications of this move have shed light on the evolving dynamics of the financial sector. Key points discussed in the article highlighted the collaborative efforts of these industry leaders in developing innovative solutions to address the growing demands of the market. By integrating their expertise, Nasdaq and Nuam aim to enhance market efficiency, improve trading experiences, and provide unparalleled access to financial data. This strategic partnership underscores the significance of technology-driven advancements in shaping the future of finance.

The Nasdaq-Nuam partnership signifies a pivotal moment in the industry’s transition towards digitalization. As technology continues to play a pivotal role in shaping market trends, the partnership’s impact will be felt across the financial landscape. Market participants can expect to witness increased efficiency, reduced transaction costs, and improved access to real-time market data. This development also demonstrates the industry’s adaptability to emerging trends, as Nasdaq and Nuam position themselves at the forefront of innovation. As the partnership continues to evolve, it will be intriguing to observe how this collaboration influences the broader market.

As we look to the future, the Nasdaq-Nuam partnership serves as a testament to the industry’s unwavering commitment to progress. As technology continues to propel the financial sector forward, one thing is clear: the future of finance is being written in code. As the digital revolution unfolds, the boundaries between traditional and digital markets will continue to blur. The partnership between Nasdaq and Nuam serves as a harbinger of what’s to come – a future where technology, innovation, and collaboration converge to shape the ever-evolving landscape of finance.