## ⚡ Tesla Stock Just Issued a Red Alert: Death Cross Incoming! ⚡

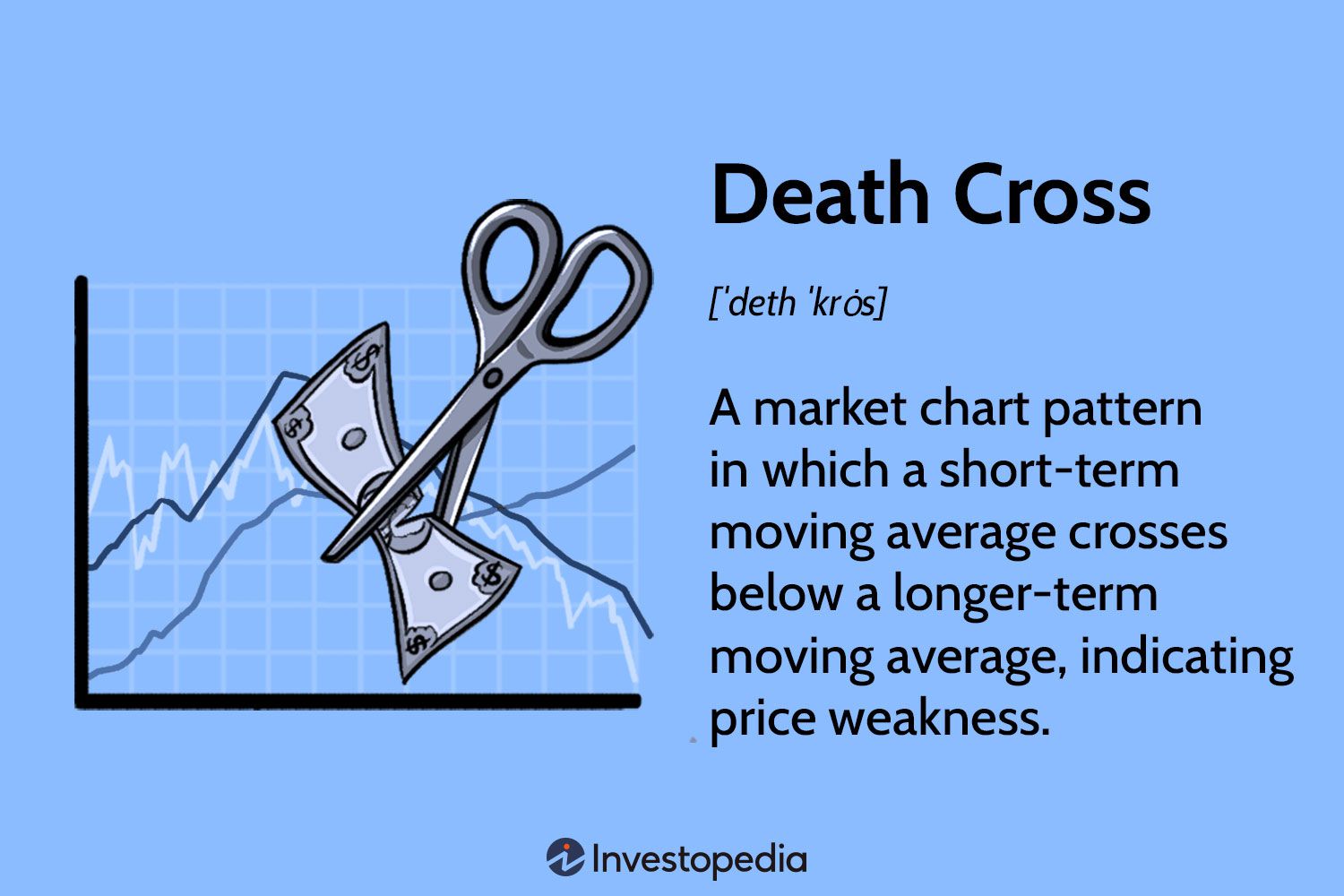

Hold onto your hats, Tesla fans, because Wall Street just sent a shiver down the spine of the electric car giant. Tesla stock has formed a dreaded “death cross” – a technical signal that has historically been a harbinger of trouble.

But what exactly is this ominous pattern, and what does it mean for your investments? Does this signal the beginning of the end for Tesla’s meteoric rise, or is it just a temporary dip in the road?

Tesla’s Recent Performance and Fundamental Factors

Tesla (TSLA) has experienced a significant decline in its stock price recently, culminating in a classic “death cross” pattern. This technical indicator, where a short-term moving average crosses below a long-term moving average, often signals a period of weakness in the market. While not necessarily a harbinger of doom, it does raise concerns about Tesla’s near-term prospects.

Several factors have contributed to Tesla’s recent struggles. The company’s high valuation, which was based on growth expectations that have yet to materialize, has come under pressure from rising interest rates and a broader market downturn. Additionally, increased competition from established automakers and new EV entrants has put a dent in Tesla’s market share.

Despite these challenges, Tesla still boasts strong fundamentals. The company remains a leader in electric vehicle production and sales, with a loyal customer base and a growing network of charging stations. Its innovative technology and ambitious goals continue to attract investors, albeit with a more cautious approach in recent months.

Impact of Industry Trends and Competition

The automotive industry is undergoing a rapid transformation, with electric vehicles (EVs) becoming increasingly mainstream. This shift presents both opportunities and challenges for Tesla. The company’s early mover advantage has given it a significant lead in the EV market, but it faces growing competition from established automakers such as Volkswagen, General Motors, and Ford, as well as new entrants like Rivian and Lucid Motors.

These competitors are investing heavily in EV development and production, and they are starting to make inroads into Tesla’s market share. Tesla’s response has been to ramp up production, expand its lineup of models, and invest in new technologies, such as self-driving capabilities. However, maintaining its dominance in the rapidly evolving EV market will require continued innovation and strategic execution.

The Impact of Rising Interest Rates

In addition to competition, Tesla’s stock price has also been affected by rising interest rates. Higher borrowing costs make it more expensive for companies to finance their operations and investments, which can impact profitability and growth prospects. Tesla, which relies heavily on debt financing, has been particularly vulnerable to this trend.

Investor Sentiment and Market Psychology

Investor sentiment plays a crucial role in shaping stock prices. Tesla’s stock has long been considered a speculative investment, driven by its growth potential and the vision of its CEO, Elon Musk. However, recent market volatility and concerns about Tesla’s performance have led to a decline in investor confidence.

The “death cross” pattern, coupled with negative news headlines and analyst downgrades, has further fueled this negative sentiment. This creates a self-reinforcing cycle where selling pressure drives the stock price down, leading to further losses and a downward spiral.

Fear and Uncertainty

The current market environment is characterized by fear and uncertainty, as investors grapple with inflation, rising interest rates, and geopolitical tensions. This uncertainty can lead to risk aversion, causing investors to sell off stocks, including those with high growth potential like Tesla.

The psychological impact of the “death cross” can exacerbate this fear, as investors interpret it as a sign of impending doom. Despite the historical evidence suggesting that the death cross may not be as ominous as it appears, market psychology can often override rational analysis, leading to overreactions and panic selling.

Navigating the Uncertainty: What To Watch For Next

The recent “death cross” in Tesla’s stock price has raised questions about the company’s future prospects. While the technical indicator itself is not necessarily a cause for alarm, it does highlight the challenges Tesla faces in the current market environment.

Investors need to carefully assess the situation and develop a strategy that takes into account both the risks and opportunities presented by Tesla’s current trajectory.

Potential Short-Term and Long-Term Outcomes

The short-term outlook for Tesla’s stock price remains uncertain. The “death cross” pattern suggests a period of further weakness is possible, but the magnitude and duration of the decline are unclear.

The long-term outlook for Tesla remains more positive. The company’s strong fundamentals, innovative technology, and ambitious growth plans suggest it is well-positioned for continued success in the long run. However, the company will need to navigate the challenges of increasing competition, rising interest rates, and evolving consumer preferences.

Strategies for Tesla Investors in a Volatile Market

Investors with a long-term perspective on Tesla may consider the following strategies in the current volatile market environment:

- Averaging Down: For investors who believe in Tesla’s long-term potential, buying more shares at lower prices can reduce the average cost basis and potentially increase future returns.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals can help mitigate the impact of market volatility and potentially reduce the risk of buying at a market peak.

- Holding for the Long Term: Tesla’s long-term growth prospects remain strong, and short-term market fluctuations are unlikely to change that. Investors with a long-term horizon can ride out the volatility and benefit from Tesla’s potential future gains.

Expert Opinions and Market Analyst Perspectives

Market analysts and industry experts have mixed opinions on Tesla’s short-term future. Some believe the “death cross” is a sign of further weakness, while others view it as a buying opportunity.

Analyst ratings for Tesla have recently been downgraded, reflecting increased concerns about the company’s growth prospects and valuation.

However, some analysts remain optimistic about Tesla’s long-term potential, citing its strong competitive advantages, innovative technology, and growing market share.

Conclusion

So, there you have it. Tesla’s stock has formed a “death cross,” a technical indicator often seen as a harbinger of trouble. The article highlights how this bearish signal, formed by the 50-day moving average crossing below the 200-day moving average, reflects investor sentiment and growing concerns about Tesla’s future performance. While past performance isn’t always indicative of future results, the convergence of this technical signal with recent news about production delays, price cuts, and increased competition paints a concerning picture for the electric vehicle giant.

This event isn’t just a blip on the radar for Tesla investors; it signals a potential shift in the market’s perception of the company. Long-term investors will undoubtedly be watching closely, analyzing whether this “death cross” is a genuine warning sign or simply a temporary dip. The coming weeks and months will be crucial in determining Tesla’s next move. Will they weather this storm and emerge stronger, or will this mark the beginning of a prolonged decline? The answer, as with all things in the volatile world of investing, remains to be seen.

One thing is certain: the “death cross” has sent shockwaves through the market, reminding us that even the most innovative and seemingly invincible companies are not immune to the forces of market sentiment and economic pressures. The future of Tesla, and the electric vehicle industry as a whole, hangs in the balance.