“Apple has taken a major step towards making contactless payments a seamless part of daily life, rolling out its innovative ‘Tap to Pay’ feature on iPhone to even more European nations. The tech giant’s latest expansion marks a significant milestone in its push for widespread adoption of contactless payments, with the company’s mobile payments system already available in several European countries. As the shift towards cashless transactions continues to gain momentum, Apple’s ‘Tap to Pay’ feature is poised to simplify transactions and revolutionize the way we make payments, giving users even more flexibility and convenience when using their iPhones.”

Expansion of Tap to Pay on iPhone

Apple has significantly expanded its Tap to Pay on iPhone technology to several European nations, enhancing the ease and convenience of contactless payments for both merchants and consumers. This new rollout includes countries such as Poland, Switzerland, Finland, Hungary, Portugal, and others, marking a strategic move by Apple to penetrate deeply into the European market.

The expansion of Tap to Pay on iPhone in Europe is not just a technological advancement but also a response to the region’s regulatory environment. The European Union’s Digital Markets Act (DMA) has been a driving force behind this change, mandating that Apple opens up its Near Field Communication (NFC) technology to third-party developers. This decision aligns with Apple’s broader compliance with EU regulations, which seek to foster competition and innovation in the digital market. By allowing third-party payment platforms to integrate with Tap to Pay, Apple is not only meeting regulatory requirements but also creating a more diverse and competitive payment ecosystem.

Merchants in these new regions can now accept contactless payments using their iPhones and a compatible mobile point of sale (mPOS) app. This capability eliminates the need for additional hardware, making it a cost-effective solution for small and medium-sized businesses. Customers can pay using contactless credit and debit cards, Apple Pay, and various third-party digital wallets, providing them with a seamless and flexible payment experience.

For instance, in Finland, merchants can integrate Tap to Pay with platforms like Stripe, SumUp, and Viva Wallet. Similarly, Hungarian merchants can use Adyen, Global Payment, and myPOS, among others. This diverse range of options not only simplifies the payment process for consumers but also empowers merchants to choose the best payment solutions tailored to their business needs.

Apple’s decision to expand Tap to Pay on iPhone to these European countries is also a testament to the technology’s success in the U.S. and Canada. Sephora, a prominent beauty retailer, has been a notable adopter of this technology. Sephora’s implementation of Tap to Pay on iPhone in its U.S. stores has been met with positive feedback from customers, who appreciate the convenience and speed of the payment process. Sephora’s Vice President, Treasurer, Stefan Jensen, highlighted the importance of innovation and customer experience in the retail sector. “Innovation and the customer shopping journey are key pillars of Sephora’s business,” Jensen said, emphasizing how Tap to Pay on iPhone enhances the shopping experience by allowing Beauty Advisors to complete contactless transactions easily with just an iPhone.

Sephora’s success story in the U.S. has paved the way for similar implementations in Canada and now in Europe. Max Neukirchen, Global Co-Head of J.P. Morgan Payments, echoed this sentiment, noting that the expansion to Canada and Europe is part of a broader strategy to build a modern payments business. “As consumers increasingly demand fast, convenient and frictionless payments, we have a proven track record of innovating at scale to help merchants meet—and exceed—those expectations,” Neukirchen stated.

In the U.S., Sephora complements payment acceptance at existing payment terminals with Tap to Pay on iPhone, ensuring Sephora meets customers where they are and with how they want to pay. “After introducing Tap to Pay on iPhone in our U.S. stores last year, our beauty community has really embraced this new way to pay, and we’re thrilled to expand this to our Canadian market. By integrating this flexible payment solution, our Beauty Advisors can provide curated beauty recommendations and complete contactless transactions easily with only an iPhone—wherever they are in the store,” Jensen explained.

With Tap to Pay on iPhone, Sephora’s Beauty Advisors can accept contactless credit and debit cards, Apple Pay, and other digital wallets anywhere in the store simply by using their iPhone and Sephora’s proprietary mobile point of sale app – no additional hardware needed. Merchants and their customers can engage and pay anywhere with Wi-Fi or cellular service, resulting in a seamless, end-to-end payment and transaction experience.

How Tap to Pay on iPhone Works

Tap to Pay on iPhone is a groundbreaking technology that transforms a merchant’s iPhone into a mobile point-of-sale device. This functionality allows for seamless and secure contactless payments, eliminating the need for traditional payment terminals. The process is straightforward and efficient, making it an attractive option for retailers looking to streamline their payment processes.

Setting Up Tap to Pay on iPhone

To use Tap to Pay on iPhone, merchants need to have a compatible payment app and an iPhone model that supports NFC technology. The latest iPhone models, starting from the iPhone Xs, are equipped with NFC capabilities, making them suitable for this purpose. Merchants must ensure their iPhones are running the latest version of iOS to access the full functionality of Tap to Pay.

Setting up Tap to Pay on iPhone involves a few simple steps. Merchants need to update their payment app to the latest version and enable the Tap to Pay feature within the app. This process typically includes configuring the app to recognize and process contactless payment cards and digital wallets. Once configured, the merchant can start accepting payments by tapping a customer’s contactless card or digital wallet to their iPhone.

The setup process is designed to be user-friendly, ensuring that even merchants with limited technical expertise can quickly get up and running. This ease of use is a significant advantage, as it reduces the barrier to entry for small and medium-sized businesses looking to adopt contactless payment solutions.

Facilitating Transactions

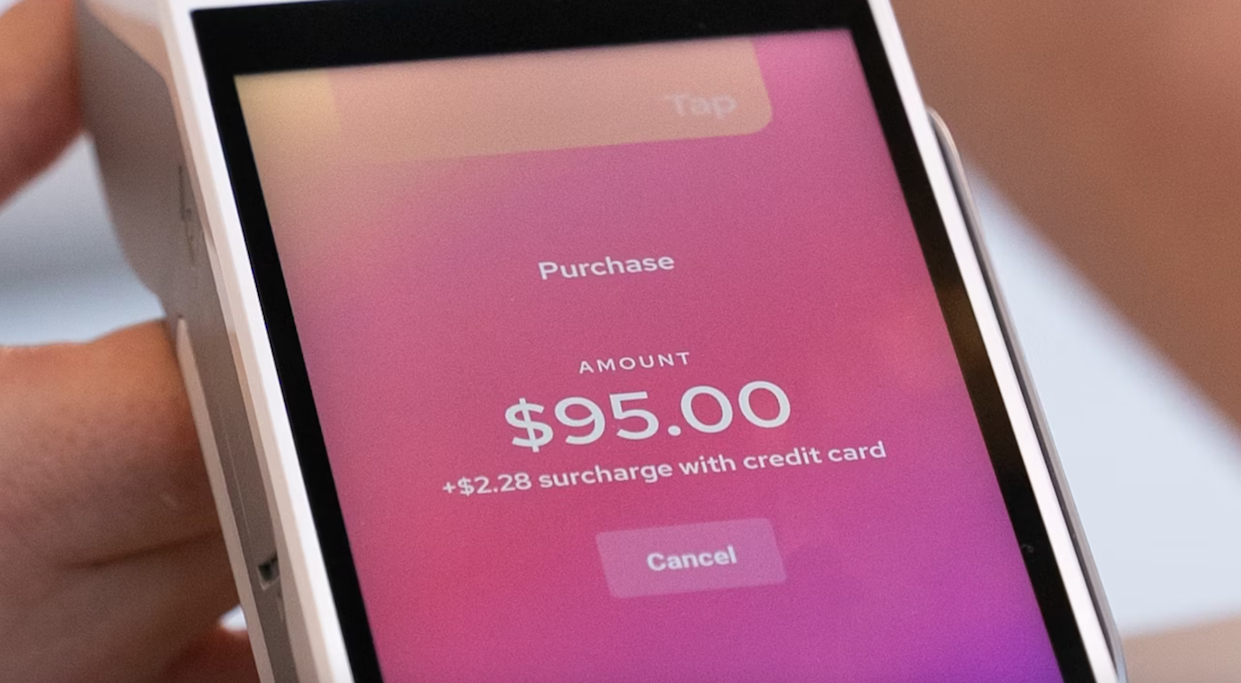

Once Tap to Pay on iPhone is set up, facilitating transactions is a straightforward process. When a customer wishes to make a purchase, the merchant selects the Tap to Pay option within the mobile point-of-sale app. The customer then taps their contactless card or digital wallet to the merchant’s iPhone, completing the payment process seamlessly.

This contactless payment method is not only convenient for customers but also enhances security. Each transaction is encrypted, ensuring that sensitive payment information is protected. This level of security is crucial for both merchants and customers, as it reduces the risk of fraud and data breaches.

For merchants, Tap to Pay on iPhone offers the flexibility to accept payments from a wide range of payment methods, including credit and debit cards, Apple Pay, and other digital wallets. This versatility allows merchants to cater to the diverse preferences of their customers, ensuring a positive shopping experience.

Additionally, Tap to Pay on iPhone does not require any additional hardware, making it a cost-effective solution for businesses. Merchants can use their existing iPhones, reducing the need for expensive investment in new payment terminals. This cost savings can be particularly beneficial for small businesses with limited budgets.

Implications of EU Regulations on Tap to Pay

Apple’s decision to expand Tap to Pay on iPhone to more European countries is significantly influenced by the EU’s regulatory framework, particularly the Digital Markets Act (DMA). The DMA aims to create a more competitive and fair digital market by mandating that major tech companies open up their services to third-party developers. This regulation has played a pivotal role in Apple’s recent policy changes, including the opening up of its NFC technology to third-party payment platforms.

Compliance with EU Regulations

Compliance with EU regulations has been a driving force behind Apple’s expansion of Tap to Pay on iPhone. The DMA requires Apple to allow third-party payment platforms to integrate with its NFC technology, fostering competition and innovation in the payment industry. By complying with these regulations, Apple not only avoids potential fines but also positions itself as a leader in promoting fair competition in the digital market.

The integration of third-party payment platforms with Tap to Pay on iPhone has several benefits for both merchants and consumers. For merchants, it provides access to a wider range of payment solutions, allowing them to choose the best fit for their business needs. For consumers, it offers more payment options, enhancing the overall shopping experience.

For instance, in Finland, merchants can integrate Tap to Pay with platforms like Stripe, SumUp, and Viva Wallet. Similarly, Hungarian merchants can use Adyen, Global Payment, and myPOS, among others. This diverse range of options not only simplifies the payment process for consumers but also empowers merchants to choose the best payment solutions tailored to their business needs.

Apple’s compliance with EU regulations has also led to the opening up of its NFC technology to third-party developers in the U.S. and Canada. This functionality came in a software update as part of iOS 18.1, further expanding the reach of Tap to Pay on iPhone. This move aligns with Apple’s broader strategy to comply with regulatory requirements while fostering innovation in the payment industry.

Impact on Payment Industry

The expansion of Tap to Pay on iPhone to more European countries has significant implications for the payment industry. The integration of third-party payment platforms with Tap to Pay on iPhone fosters competition, encouraging innovation and better services for consumers. This competitive environment can lead to lower fees, improved security, and more user-friendly payment solutions.

For merchants, the ability to accept a wide range of payment methods can enhance customer satisfaction and loyalty. By offering multiple payment options, merchants can cater to the diverse preferences of their customers, ensuring a positive shopping experience. This flexibility can also attract new customers who prefer certain payment methods over others.

The impact of Tap to Pay on iPhone extends beyond Europe, as similar expansions in the U.S. and Canada have demonstrated. The technology’s success in these regions has paved the way for its adoption in Europe, highlighting its potential to revolutionize the payment landscape worldwide. As more merchants adopt Tap to Pay on iPhone, the payment industry is likely to see increased innovation and competition, benefiting both consumers and businesses.

The integration of third-party payment platforms with Tap to Pay on iPhone also has implications for financial institutions. Banks and payment providers can leverage this technology to offer their own payment solutions, expanding their reach and customer base. This collaboration between Apple and financial institutions can lead to more seamless and integrated payment experiences for consumers.

Overall, the expansion of Tap to Pay on iPhone to more European countries is a significant development in the payment industry. It not only complies with EU regulations but also fosters innovation, competition, and better services for consumers. As more merchants and consumers adopt this technology, the payment landscape is expected to evolve, offering more convenient and secure payment options.

For Instachronicles’ audience, this development underscores the importance of staying informed about technological advancements and regulatory changes in the payment industry. As the landscape continues to evolve, businesses and consumers alike must adapt to new technologies and payment methods to remain competitive and relevant.

Instachronicles will continue to provide comprehensive coverage of these developments, ensuring our readers are well-equipped to navigate the ever-changing world of technology and finance.

Apple Expands Tap to Pay on iPhone in Europe

Apple has extended its Tap to Pay technology to several European nations, including Poland, Switzerland, Finland, Hungary, and Portugal, among others. This move is a significant step forward in the evolution of contactless payments and is particularly noteworthy for the company’s compliance with stringent regulatory standards, especially in the European Union.

The expansion of Tap to Pay on iPhone in Europe is a result of EU regulatory pressure. Faced with the prospect of substantial antitrust fines, Apple decided to allow third-party developers access to its Near Field Communication (NFC) technology. This decision has opened up new payment options for both merchants and consumers, enabling a more diverse payment ecosystem that includes a range of third-party wallet applications.

Third-Party Payment Platforms in Europe

The introduction of third-party payment platforms in various European countries is a testament to Apple’s commitment to fostering innovation and competition. In Finland, users now have the option to use platforms such as Stripe, SumUp, and Viva, while in Hungary, Adyen, Global Payment, and myPOS are among the available third-party solutions. This diverse array of payment platforms enables consumers to choose the method that best suits their needs, enhancing the overall payment experience.

Software Updates and Integration

Tap to Pay Functionality in iOS 18.1 and Later

The Tap to Pay functionality is now available in iOS 18.1 and all subsequent versions. This update has been critical in allowing merchants and users to adapt to the new payment method seamlessly. The integration of Tap to Pay into the existing payment infrastructure has been designed to be user-friendly and straightforward, requiring no additional hardware beyond the iPhone itself.

Integration into iOS Apps

Merchants are now able to incorporate Tap to Pay directly into their iOS apps, making it easier to process payments in any setting without the need for additional hardware. This flexibility is particularly beneficial for small and medium-sized businesses, who can now offer a more seamless payment experience to their customers, thereby enhancing customer satisfaction and potentially increasing sales.

Broader Impact of Apple’s Tap to Pay Expansion

Opening of NFC Technology to US and Canada

The expansion of Tap to Pay functionality to the United States and Canada follows a similar regulatory push for market competition and consumer choice. In the U.S., major retailers such as Sephora have already begun to integrate Tap to Pay into their existing payment systems. Sephora’s integration of Tap to Pay into its proprietary mobile point of sale app allows for more flexible and efficient transactions, enabling Beauty Advisors to process payments anywhere in the store without the need for traditional payment terminals.

Implications on the Payments Industry

The introduction of third-party integration into Apple’s Tap to Pay system has profound implications for the payments industry, contributing to a more competitive and versatile market. This shift not only increases consumer choice but also promotes innovation among payment service providers. The variety of payment methods and the ease of integrating these methods into existing business operations can lead to a more inclusive and technologically advanced payment environment.

Practical Aspects for Merchants and Customers

The practical aspects of Tap to Pay on iPhone are designed to streamline the payment process for both merchants and customers. Merchants can easily integrate the Tap to Pay function into their existing iOS apps, reducing the need for additional hardware investments. Customers benefit from a more flexible and personalized payment experience, as they can choose from a variety of payment methods that best suit their preferences.

Transaction Security and Privacy

Security and privacy remain paramount in the Tap to Pay system. Apple has implemented robust security protocols to protect user data and ensure secure transactions. Features such as Face ID and Touch ID are integrated into the payment process, providing an additional layer of security against unauthorized transactions.

Consumer and Merchant Benefits

The benefits of Tap to Pay extend beyond mere convenience; they include enhanced security features, streamlined payment processes, and an expanded range of payment options. For merchants, the ability to integrate Tap to Pay into their existing systems without additional hardware investments can lead to cost savings and increased operational efficiency. For consumers, the variety of payment methods and the security provided by features like Face ID and Touch ID make the Tap to Pay system a compelling option.

Expert Analysis

Industry experts have noted that the broadening of Tap to Pay’s reach and the inclusion of third-party platforms are significant steps toward a more open and competitive payment market. The move aligns with broader trends toward increased payment flexibility and security, where the user experience is paramount. The integration of Tap to Pay with popular apps and services enhances the overall functionality and appeal of Apple devices, especially in the context of mobile commerce.