Cryptocurrency Market in Turbulence: XRP Shorts Refuse to Budge, DOGE Faces Downward Spiral, and BTC Dominance Hits a New High

DOGE’s Price Movement and the Potential for Further Decline

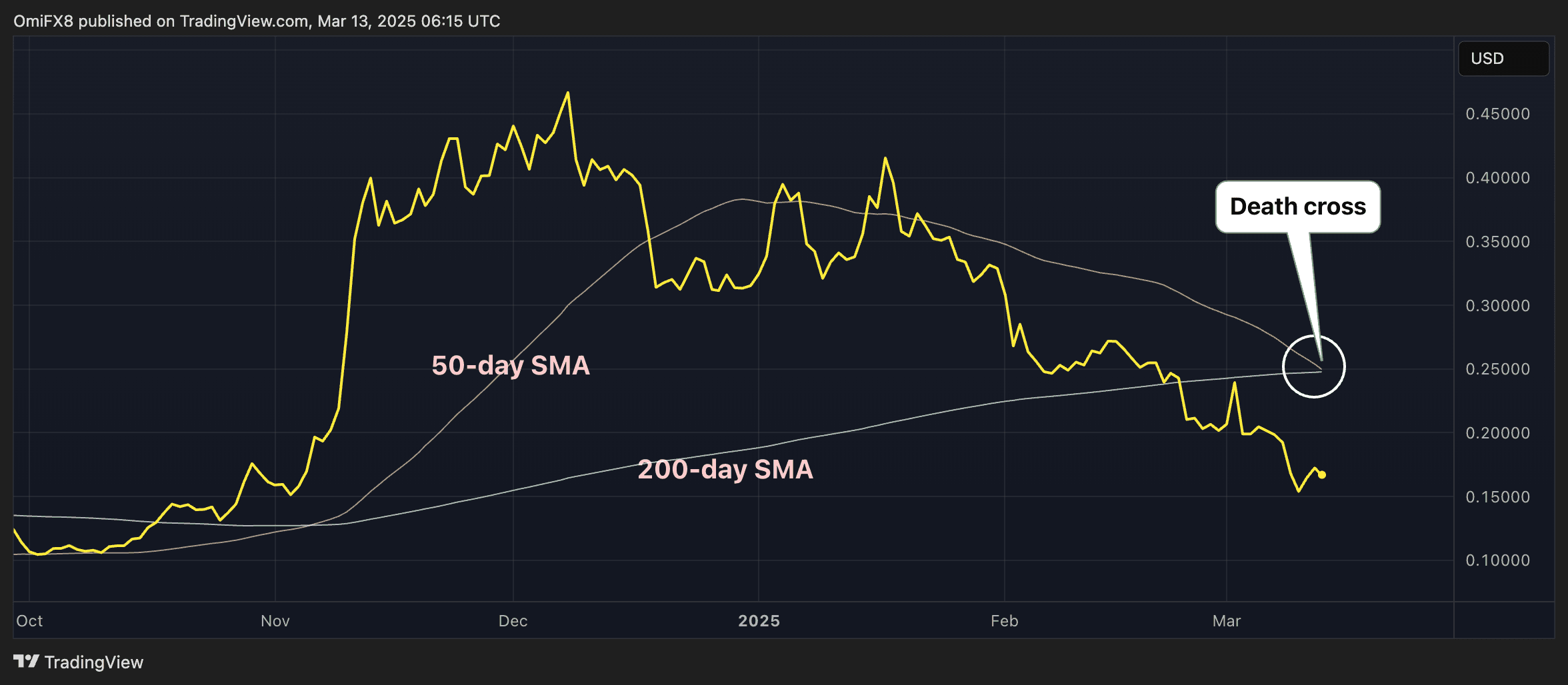

DOGE, the token behind the popular meme-inspired cryptocurrency, has been on a downward spiral since peaking at over 48 cents in December. The token has dropped a staggering 65% since then, and its impending “death cross” may signal further decline.

The 50-day simple moving average (SMA) of DOGE’s price is about to cross below the 200-day SMA, a trend analysis known as the death cross. This ominous-sounding pattern indicates that the short-term price momentum is now underperforming the long-term momentum, with the potential to evolve into a major bearish trend.

These SMA crossovers are widely followed by trend traders, meaning the confirmation of the death cross could bring more selling pressure to the market. However, long-term SMA crossovers are lagging indicators, reflecting the sell-off that has already materialized and have a mixed record of predicting price moves in the BTC and ETH markets.

Trend Analysis

Long-term SMA crossovers are often used as lagging indicators to analyze market trends. While they can provide valuable insights into market momentum, they have a mixed record of predicting price moves in the BTC and ETH markets.

In the case of DOGE, the impending death cross may indicate further decline, but it is essential to consider the token’s overall market performance and the current market conditions.

DOGE’s Recent Performance

DOGE’s recent price action has been largely driven by its 65% drop since peaking in December. This decline has led to a significant decrease in the token’s market capitalization, making it an attractive target for short sellers.

The cumulative open interest in perpetual futures listed across major exchanges has stabilized near 1.35 billion XRP, with annualized funding rates and cumulative volume delta printing negative. This indicates the dominance of bearish short positions in the market, which could continue to put pressure on DOGE’s price.

Bitcoin Dominance Surges

BTC’s Rise to the Top

Bitcoin’s dominance rate, or the cryptocurrency’s share in the total market capitalization, has increased to 62.5%, the highest since March 2021. This surge in dominance is largely attributed to the broader market downturns, which have led investors to seek safer havens.

The metric has increased from 55% to over 62% since the total crypto market capitalization peaked above $3.6 trillion in December. This significant increase in dominance signifies a continued preference for BTC, particularly during market downturns.

Market Capitalization and BTC’s Share

The total market capitalization of the cryptocurrency market has seen a significant decrease since its peak in December. This decline has led to a redistribution of market share, with BTC emerging as the clear leader.

BTC’s market capitalization now accounts for 62.5% of the total market capitalization, making it the dominant cryptocurrency in the market. This increased dominance is a testament to the continued popularity and trust in BTC as a safe-haven asset.

BTC’s Future: A Safe Haven?

BTC’s recent market performance and future prospects as a safe-haven asset are worth examining. The cryptocurrency’s market capitalization has seen a significant increase in recent months, making it an attractive target for investors seeking a safe haven.

The increased dominance of BTC can be attributed to its long-standing reputation as a safe-haven asset. Its limited supply, decentralized nature, and widespread adoption have made it a popular choice for investors seeking a safe and secure store of value.

Conclusion

In the article “Bias for XRP Shorts Persists Despite Rally, DOGE Heads Into ‘Death Cross’; BTC Dominance Surges – CoinDesk,” we delved into the current market trends and analyzed the performance of various cryptocurrencies, including XRP, DOGE, and Bitcoin. The article revealed that despite XRP’s recent rally, the bias towards shorting the cryptocurrency persists, indicating a lack of confidence among investors. Meanwhile, DOGE is heading towards a “death cross,” a technical indicator that suggests a potential decline in the coin’s value. On the other hand, Bitcoin’s dominance has surged, indicating a shift in investor sentiment towards the flagship cryptocurrency.

The significance of these trends lies in their potential impact on the overall cryptocurrency market. The persistence of shorting bias towards XRP could lead to further volatility and potentially even a decline in its value. DOGE’s impending “death cross” could also result in a decrease in its value, affecting its adoption and usage. However, Bitcoin’s surge in dominance could indicate a shift towards a more stable and reliable store of value, potentially leading to a decrease in market volatility.